In year 2009 we will see the biggest project BLUEBEAM will launch by Illuminati(shadow government) on global.This will make people all around the world live in scariest life.One world one goverment will be launch starting in next year.

PROJECT BLUEBEAM

Wednesday, December 24, 2008

Next year 2009 Project BLUEBEAM will begin on global.

Tuesday, November 4, 2008

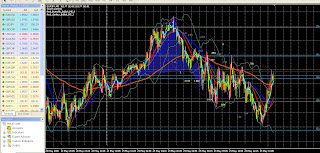

Euro/Jpy tonight(or morning)

The picture above show next movement for currency Euro/Jpy trend for this night.After reach the Ressistance R2 128.73 trend will be going down.If have Fundamental News and good for Europe it will going up to the Ressistance R3 130.59.We will see the trend will start change the movement position at 10.30~11.00 pm Malaysia time.

This article type at 8.21 pm tuesday night Malaysia time.May the profit with us.Syukran with the rezki that Allah give to us.Said Alhamdulillah.

Thursday, October 23, 2008

Naked Trading Technic.

Here i'm give my others technic in trading....I give it Naked Trading Technic because its use half than the capital to tade in currency trading market.If you all want to used it you must confirm the signal and where the chart trend to go and must confident with your analysis.....Many people have request and asked me for the simple and quick profit technic. Here i give it free.Take it....

* Used 50% or 40% from the capital and trade,take target profit 10 pips or 20 pips and then close the profit.Used it for 20 day market trading.I'm always used this technic for pair Euro/Jpy and Euro/Usd.I'm prefer trade Euro/Jpy(refer 1 hour timeframe for movement and 5 minutes timeframe for trade-open 2 timeframe) because it's easy to get the target.Trade in the European session and US market close session.And dont forget to set stop lost 40 pips.After got the target please turn off your PC and go away from your PC,go for sosial with your wife,friend ,children or anything .In two weeks you can double your capital if you dicipline used it every day market trading(20 day).InsyaAllah.

Wednesday, October 22, 2008

Major movement for pair Euro/Usd & Euro/Jpy.

Start this week untill end of Non Farm all pair Euro is in major downtrend.If the trend going up,it just warm up take a breath to major movement going down.We see what will happened after the Non Farm.

Tuesday, October 21, 2008

Lehman Brothers conspiracy liar liar.

This main conspiracy from this conspiracy is to blazing the economy crisis with the Lehman Brothers leading.This situation was create to take the US goverment money to flow and support the jews in Israel to prepare and create the world war 3.

Tuesday, October 7, 2008

E/J Today.

Here for Euro/Jpy for today movement prediction.The movement depend news announcement.May the profit with us.

Friday, October 3, 2008

Non-Farm Employment

U.S. employers slashed jobs for an eighth consecutive month in August and the nation's unemployment rate soared to a five-year high of 6.1%, up from 5.7% in July and 4.7% from one year ago. That's the highest it has been for 5 years.

In August, the economy suffered a net loss of 84,000 jobs, worse than the market forecast for a 75,000 decline. Additionally, job losses in June and July turned out to be much higher than originally reported. The economy lost an astounding 100,000 jobs in June and another 60,000 in July, according to revised figures. Previously, the Labor Department reported job losses at 51,000 in each of those months. So far this year, job losses have totaled 605,000.

Despite this, consumer confidence continued to edge up from record lows, rising 1.3 points in September to 59.8 versus an upwardly revised 58.5 reading in August. This gain was led by a significant 6.4 point gain in the expectations component to 60.5. If the past holds true, this rise in expectations points to overall improvement in the coming months. Furthermore, the US dollar rose today to its highest level in over a year against the Euro and other major currencies after the ECB opened the door for its first rate cut in five years.

For week ending September 27, the Labor Department reported that the advance figure for seasonally adjusted initial claims was 497,000, an increase of 1,000 from the previous week's revised figure of 496,000. It is estimated that the effects of Hurricane Gustav in Louisiana and the effects of Hurricane Ike in Texas added approximately 45,000 claims to the total. The 4-week moving average was 474,000, an increase of 11,500 from the previous week's unrevised average of 462,500.

Notwithstanding the increase in consumer confidence and strengthening of the US dollar, August's nonfarm payroll report showed the increasing toll that the housing, credit and financial crises are taking on the economy. With the employment situation seemingly deteriorating, there's growing worry that consumers will recoil, throwing the economy into a tailspin later this year or early next year. If unemployment continues to climb, watch for the Fed to ease its base interest rate.

source from interbenkfx.

Happy Aidilfitri.

Happy Aidilfitri to all muslimin and muslimat in this world.May Allah bless us.Dont forget to other people whom live not easy and poor.Syukur for the rezki Allah give to us.

Friday, September 12, 2008

E/J Today.

Please see the picture above.Euro/Jpy currency pair will going down and touching the support line 2 (S2).This movement valid untill next monday morning.This article was write at 8.10pm Malaysia time.Europe economy really broken the leg.Dont know when it will going up again.

Monday, September 8, 2008

Euro/Jpy today...

The picture above show the Euro/Jpy pair movement.It will touch untill support S2 Valid untill tomorrow morning Malaysia time.This article was write at 5.15 pm malaysia times.

Friday, September 5, 2008

Tonight NFP source

Where US NFP should go tonight(Malaysia time)?

Consensus Estimate 60K to 75K Loss in Payroll Jobs

Nonfarm payroll (NFP) employment continued its downtrend in July with U.S. employers shaving 51,000 jobs, marking the first time since May 2002 that the economy lost jobs for seven consecutive months. The Labor Department also reported last month that the U.S. unemployment rate rose to 5.7 percent—its highest level in more than four years—erasing all job gains made over the last year. Revisions to May and June's payrolls showed a total of 26,000 fewer jobs were lost than previously expected, bringing the number of jobs lost so far in 2008 to 463,000.

On the inflation front, the Commerce Department reported last week that the GDP price index was revised to an annualized 1.2 percent—up from the initial estimate of 1.1 percent—virtually eliminating any claims of recession for spring. The sharp easing in overall price index was technical in nature, caused by a spike in nominal imports cutting into nominal GDP growth. In contrast, the inflation for final sales of domestic purchases was revised up to a strong 4.3 percent, compared to the initial estimate of 4.2 percent.

Here are the several key factor are throught to have influence in AUGUST NFP.

They include:

• Employment continued to fall in construction, manufacturing, and several service-providing industries, while health care and mining continued to add jobs

• Notable decreases were also seen in retail trade and wholesale trade—each down 17,000 for the latest month

• The decline of 51,000 in payrolls represents a 0.04% drop that is consistent with the recent trend of declines at about a 0.5% annual rate

• Hourly earnings rose by 6 cents, bouncing back to a 0.3% gain over the month

• Average weekly hours slipped to 33.6 hours in July from 33.7 hours in June

For week ending August 23, the Labor Department reported that the advance figure for seasonally adjusted initial claims was 425,000, a decrease of 10,000 from the previous week's revised figure of 435,000. They also reported a four-week moving average of 440,250, a decrease of 6,000 from the previous week's revised average of 446,250.

The July employment report shows that although the labor sector is weaker than many have been expecting, the payroll declines still are not large enough to pull the overall economy into recession. The bottom line is that the economy has been growing much better than expected despite the credit crunch. It is still likely that the economy will slow during the second half, but perhaps not as much as the Fed needs. Look for the Fed to increase rates in January.

Wednesday, August 27, 2008

Today E/J pair currency.

Assalamualaikum and regards...

Long time no post in my blog...sorry...because i'm testing and backtest my system...Here i'm post what will happened for currency Euro/Jpy for today movement untill morning Malaysia time.This pair very gorgeous and hungry same like Gbp/Jpy.Give me so many profit...Ok good luck guys and girl...After touch the R2 line its depend the fundamental news,maybe it will goig up touch the R3 line or going down...This post article was write at 9.50 pm Malaysia time 27/8/08.

Thursday, July 31, 2008

My forex system free download.

Ok my friend many all of you want my system to used it in their forex trading.Here i'll have upload it in biz hat hosting.Please download it there.Free download...i'll put the link in my blog beside bottom the chitchat box.

Ok i'll like to upload my files in biz hat hosting because everyone have download my file bizhat will pay money for every file that have been download.

Sign up here if you like to upload the file and get pay USD 1 after registration.Here the link to register.

Get pay USD1 to register and upload your file.

Thursday, July 17, 2008

US dollar, Inflation and relevation with gold

The case above will make effects to the gold price.

- US Dollar going down,the price of gold immediately goes up because gold mostly mined in the contry not using the US Dollar.The exchange rate differrences make gold more expensive in terms of US Dollar.

- Gold has been used as a hedge against inflation for thousand of years.It is the best form of money to hold during times of inflation.When people start to buy more gold as hedge,it creates demands which raises the price of gold.Double benefit.

When the stock market went up for the last year,the gold price went up even more.

When the US Dollar went down above the few years,the gold price went up.

Now when the stock market going down,thw gold price is still going up.

Currency Correlation

Here are the correlation currency with others currency.

Gold=Pound Sterling=Euro=crude oil .

Gold going up and the others correlation currency will going up.

Tuesday, June 10, 2008

Still in backtest.

New system still in backtest.

Last month i'll have show my new system,but untill now i'm still testing this new system and i have combine it with others system to make it my accurate system.You can see it in the picture above.How powerful is it.Im combine it with modified brain system,buy/sell system.It's really work and easy.But for the butterfly/gartley system its not work properly.Still make my chart slow to loading when i'm open my chart.If you want it please put your email in my chart box.Im giving it free.

Euro/Usd target

Today Euro/Usd target with new system.

Please see my chart above.My target is at Support line S2 at 1.5520.I dont take so much profit because my stand point is take a few and then bigger like a mount and profit.I'm using modified brain trading system for 1 hour chart for my referrence.So nice an easy.This system have news announcement at the top of the chart.

Friday, May 30, 2008

My new forex system

My new forex system.

Please see my new forex system.Haha so colourful and beautiful.This is my new system make perfect to me in trading forex market.I really like it.The indicator show the butterfly,the beautiful animal in the world.If all of you want this indicator please leave your mail in my chat box.I will send it to your mail.

Wednesday, May 21, 2008

Crude oil shooting above 133 USD perbarrel

Wow the crude oil hits above 133 uS Dollar perbarrel....

Firstly please forgive me because long time no post the article or anything in my blog.I really busy in my carrier.So now i have much time to post in my blog about the forex,oil and gold...

ok here my new post today...

crude oil hits above 133 USD perbarrel.Why the oil price jumps up?

The fact that refinery production jumped up contributed to the decrease in stockpile of crude oil and continuing a weakening Dollar.What i have seen over the last four days, oil has gained more than $9 per barrel.Here the news..

New York's main oil futures contract, light sweet crude for July delivery, crossed 130 dollars for the first time then hours later raced to a record high of 133.82 dollars after the worrying US energy stockpiles report.

The benchmark futures contract closed a whopping 4.10 dollars higher at a record 133.17 dollars.

In London, Brent North Sea crude for July delivery settled at a record 132.70 dollars a barrel, a gain of 4.86 dollars. Brent hit a record intraday high of 133.34 dollars.

An already rallying oil market was galvanized by the US Department of Energy's weekly snapshot of energy inventories, which unexpectedly showed declines.

source from AFPBeware,the oil prices will continue to run up untill 180 US Dollar perbarrel for this year.I have heard from someone the crude oil will disappear totally after 3 bigger fire.After that all people in this world will not using oil for their car and maybe no car in road but using horse like the old age.

Tuesday, April 29, 2008

US Dollar consolidates as Federal rate cut.

This week we will see the US Federal Reserve(FOMC) decision cut rate 25bp rate on this wednesday 30 April.The US Dollar will become strong again for this week.For currency pair Euro/USD will become weak and turning slithgly bearish.Euro/JPY will follow Eur/USD same as bearish down trend.So the conclusion for this week is major downtrend for this 2 pair.

Friday, April 25, 2008

Today forex for pair Eur/Jpy falling down.

Yesterday was time for pair Eur/Jpy and Eur/Usd to falling down after part last week crazily going uptrend. Next 2 weeks we will see this 2 pair will going to downtrend because this 2 week the US Dollar will become strong.Eur/Jpy will going up for uptrend after the NFP news announcement.

We will see what will happened to this my most profit and favourite pair Eur/Jpy and Eur/Usd next week.

Tuesday, April 22, 2008

Oil price new high record.

Today oil price go to new high record close about USD118.54 perbarrel.Supported by concerns about instability in crude supplies from some producers.The Nigeria sabotage news could drastically affect because militants sabotaged a pipeline last week in southern Nigeria, where militancy and lawlessness had grown in recent years.

The orthers thing is about the dollar fell to a new low against the Euro.The Dollar fell Tuesday after the National Association of Realtors said sales of existing homes fell in March while the median home price declined, raising prospects that the Federal Reserve will cut interest rates further this year to try to shore up the ailing economy. Fed interest rate cuts tend to further weaken the dollar.

The Euro will going up up and away.US Dollar will falling down untill it will crash.Well see it what will happend in the future.

Friday, April 18, 2008

Euro/Usd fail touching 1.6 ?

The E/U pair currency having failed to break that level four times over the past few days, the EURUSD weakened in quiet overnight trade as bears tried to capitalize on lack on momentum and push the pair below the 1.5900 figure.The matter why the Euro fail to touch 1.6 because its come from the economic data,German Producer Prices reached a 15 month high on rising energy costs.

It may be just a matter of time before the euro bursts through 1.60.Today the Euro/Usd fall below 1.58.. .Maybe will drop again and again.

Maybe the Euro/Usd will continue to bursts to touching 1.6 or more in next month.

The gold price rate fall same as Euro/Usd currency tonight.The highest is 952.20 on thursday and now fall below 918/oz.The Euro/Usd now have same move with gold.Down sharply due to euro weakness against the U.S. dollar and lower oil prices.

Friday, April 11, 2008

Tips to profit.

Here are my free tips to my blog readers for pair e/j,u/j,g/j to get profit:

- Normally this 3 pair move in same direction.

- Time at 3pm(Malaysia time) all this pair normally will move uptrend.

- Time at 11pm(Malaysia time) will move uptrend minimum 50 pip.

- If oil price up This pair J will downtrend,If oil price drop it will going uptrend.

Good luck, may the profit will be with you.

Today waiting for G7

The week has got to an end; no major changes took place in the outlook of most economies, after three economies released their rate decision with two of them not changing their rates, leaving the United Kingdom alone to cut rates with 25 basis point. Where now the attention is headed toward the G7 meeting, with most of the economies especially UK are demanding for some change, were the industrialized economies are asking china to ease up it control to let its currency appreciate against major to take off some of the pressures that are occurring in the markets.

In the early trading session yesterday we saw the shiny metal gathering up some momentum to start heading to the upside, as it was supported by the rising oil prices to an all time high in addition the weakening US dollar; but this did not last long because later in the day after the Mr. Trichet speech in a while the US dollar began gaining once again against the Euro and the Japanese Yen; this reversal movement obligated the bullion to head to downside dropping from the recorded high of $938.50 to close $10 lower at $928.80.

While today, as we just waiting to see what might be the comment in the G7 meeting; the gold ingots continued dropping to record only a high of $928.80 and a low of $920.10 as its trading now around those levels.

The bullion lost the proportional support from the Crude oil, dropping at the early Asian trading session below the $110 per barrel, after the Saudi Authorities announced that supply in the markets are sufficient at the time being which made investors' to ease down their positions, in addition the to increasing signs of a recession in the United States which would curb the consumption of oil as the United States is considered to be the largest oil consumer in the World.

Source from ibtimes

Friday, April 4, 2008

Non Farm Payroll verdict.

Non Farm Payroll fall 80k.

The US economy has now been shedding jobs for three consecutive months, and the unemployment rate has risen to its highest level in two and a half years, the Labor Department said today.

The economy lost 80,000 non-farm payroll jobs in March, compared to the 50,000 job loss economists polled by Thomson's IFR Markets had expected.Today's report marks the first time since June 2003 that the economy lost jobs in three consecutive months, and the 80,000 decline was the biggest loss since March of that year.

Picture above are show the trend chart where the news Non Farm Payroll release.Chart spike going up an down.Forex market going unstable 10 minutes before the news actual data realese.

Thursday, April 3, 2008

March NFP better or worse?

Today is The first week of the month where the NFP-nonfarm payrolls data will realese.When the data realease the market will moved actif and can give spike more than 100 pips

up and down volatility.

Will March Non-Farm Payrolls be Better or Worse than February?

Nearly all of the leading indicators for non-farm payrolls indicate that March was a month of job losses. However, even though the odds are skewed towards greater job loss, conflicting reports make it important not to rule out the possibility there was less jobs lost in March than there was in February. Either way, the state of the labor market will grow increasingly worse in the coming months even if there is a rebound in March. For traders, if non-farm payrolls are better than -63k, the dollar should rally and rate cut expectations will grow in favor of a 25bp rate cut because everyone will believe that the

Wednesday, April 2, 2008

Oil price fall as dollar rises.

NEW YORK — Oil futures extended their slide Tuesday as the dollar gained ground, making commodities such as energy futures less attractive to investors seeking a hedge against inflation. But trading was choppy as a debate among investors over oil's direction played out in the marketplace.

Retail gas prices, meanwhile, slipped slightly from the record they set one day earlier.

Investors who previously bought commodities such as oil as a haven against inflation and a falling dollar sold Tuesday as the greenback strengthened against the euro and other currencies. The stronger dollar also made oil more expensive to overseas investors.

Many analysts say oil investors have taken most of their price cues in recent months from gyrations in the dollar.

"The dollar's stronger, and [therefore] oil's weaker," said Brad Samples, an analyst with Summit Energy Services.

source from seatle times

Monday, March 31, 2008

Is it true?

WORLD PREDICTION IN 2008

* US dollar will crash

* Gold will soar $1000 per ounce

* Fuel and energy to rise

* Middle East War Escalates With Iran

* World Recession Storm Clouds Gather

* Israel Massacre will be begin if war happened in Iran.

* Volcanic Activity Warning to Japan and Indonesia.

We'll see it.Is it will happened.

But im know that the US will be collapse some day and gold price will soar.

Sunday, March 30, 2008

Reason why you should own gold.

Here are the 9 reason why you should own gold

Gold is the perfect commodity.Why?

* Gold is liquid and easily traded, with a narrow spread between the prices to buy and sell (about 1%).

* Gold is money because it is divisible, you can divide it into coins, or re-melt it into bars, without destroying it.

* Gold is easily transportable, because it has a high value for its weight.

* Also, gold is interchangeable. It can be substituted for another piece of gold with no hassle.

* When measured by weight, gold is easily countable, and verifiable.

* Gold is also nearly impossible to counterfeit, as genuine gold is easily recognizable.

* Gold is money because it is a great store of value. It is not subject to decay, rot, or rust.

* Gold has an intrinsic value, because it is rare, highly desired by the world over, and is a luxury item.

* Gold rate always going up.

Better you buy gold save it for the futures.You will need it in the future.Its better save gold than save the money.

Saturday, March 29, 2008

RULES FOR TRADERS.

Here are some of the general rules that you should not messing around with:

- Never ever enter a position when you don't have any clear entry signal from your indicator system.

- Be patient and never ever predict the next movement of the market without a proper analyzing system.

- Don't be too greedy and stick to your trading plan (if you have one).

- Make sure you have a good internet connection.

- Double check your entry before you finalize it.

- Stick with a system which you are familiar with.

- Always lookup for any news related to the currency that you trade.

No matter what system that you are using currently, for me those are some of the important things you have to lookup before open trading position. Even not much and you think some of them are just crap, but believe me, those crappy things will determine either you are a wise trader or just another idiot trader alive.

I''l believe with this rules you can survive in forex and can save your money.

If you follow these rules,i'll believe you will be successful. Another things is be smart by go for the dollar than pips, trust me, bcoz you can make 100 to 300 of pips but it is still useless if the value per pips is only 10 cents.It's better smaller pips with big profit than hundred or thousand pips but small profit.

Monday, March 24, 2008

MY SIMPLE FOREX TRADING SYSTEM

Forex trading system

Here are the free gift from me to my blog readers.This trading system is very simple and not make my head sick when im doing my trading.

I'm use 3 EMA crossing small movement 1 Bigger Ema for my refference for market bigger moved.

Here are the setting:

--EMA 5 exponential

--EMA 14 exponential

--EMA 28 exponential

and 1 bigger

--EMA 100 exponential

This system can use in timeframe 5min/15min/30min.

Mostly 85% the EMA system will crossing when have a medium or highest news when the market open.

Before half and hour the market news release i will close all my open profit trading.Why?

Because at this range of time the market actif and bedlam it will change the direction if dont have a good news for the main currency.

This system very simple.When the ema crossing up,open post buy,when the ema crossing down open post sell.Then you can do other job and come back sit infront of Pc 1 hour before the news anouncement.

Saturday, March 22, 2008

Way to analysis Forex Market

2 types forex analysis

Technical Analysis

Technical analysis focuses on the study of price movements. Historical currency data is used to forecast the direction of future prices. The premise of technical analysis is that all current market information is already reflected in the price of that currency; therefore, studying price action is all that is required to make informed trading decisions. The primary tools of the technical analyst are charts. Charts are used to identify trends and patterns in order to find buying and selling opportunities. The most basic concept of technical analysis is that markets have a tendency to trend, or either increasing or decreasing. Being able to identify trends in their earliest stage of development is the key to technical analysis.

Fundamental Analysis

Fundamental analysis focuses on the economic, social and political forces that drive supply and demand. Fundamental analysts look at various macroeconomic indicators such as economic growth rates, interest rates, inflation, and unemployment. However, there is no single set of beliefs that guide fundamental analysis. There are several theories as to how currencies should be valued.Fundamentals Every Trader Should KnowCurrency prices reflect the balance of supply and demand for currencies. Two primary factors affecting the supply and demand are interest rates and the overall strength of the economy. Economic indicators such as GDP, foreign investment and the trade balance reflect the general health of an economy and are therefore responsible for the underlying shifts in supply and demand for that currency. There is a tremendous amount of data released at regular intervals and some of the data is more important than others. The ones that are looked at more closely are those related to interest rates and international trade.

THE MOST IMPORTANT INVESTMENT REPORT IN 2008

Source : Elliot Wave International

In January 2007, The Elliott Wave Financial Forecast issued a special report called “2007: The Year of Financial Flameout.” The forecast in that report has largely come to pass. This year, we’ve delivered a NEW, up-to-date special report entitled “2008: The Year Everything Changes.”

This could well be The Most Important Investment Report You’ll Read in 2008. Obviously, most of the forecasts in this report will unfold in the future – but in the present, it’s YOURS FREE !

!

Even as you read this, the financial markets and economy are confirming the scenario spelled out in “The Year Everything Changes.” Please don’t wait. Your portfolio cannot afford to be without these valuable market insights.

It’s not too late for you to position yourself for the short- and long-term opportunities just around the corner.

The Most Important Investment Report You’ll Read in 2008 is yours free when you take 30 seconds to Join Club EWI , also FREE.

, also FREE.

Friday, March 21, 2008

Money management

How to manage your capital money in forex market.

Money management is a way traders control their money flow: in or out of pockets... Yes, it's simply the knowledge and skills on managing a personal Forex account.

Mostly 90% of the new forex traders are failed and going into bankruptcy but the other 10% can survive because of the money management how they use their money in the forex market when trading.Mostly for the newbie their going to loss their money in first three month because dont know how to manage their money in forex market.

It is so important.The main idea of the whole trading process is to survive!

Survival first, and only then making money on top.One should clearly understand, that big traders first of all are skillful survivors. In addition, they usually have deep pockets, which means that under unfavorable conditions they are financially able to sustain big losses and continue trading. For the ordinary traders, the majority of us, the skills of surviving become a vital "must know" platform to keep trading accounts alive and, of course, to make good stable profits.

Here are the simple formula how to manage the money.

- Always use maximum 10% from the capital money.

- From the 10% divide it 5/10 trading position to minimum the loss risk.

- Don't break this rule.Survive first.

Forex learning

How to learn forex.

Forex is fast becoming the hottest market for retail traders, and work from home professionals. Many new traders are trying to learn Forex from books, but that is a difficult way to learn. It's OK for the basics, but once you have them down, you are still left standing on your own, in a challenging market. A better way to learn Forex is from a live mentor. A mentor that is willing to trade with you in live market conditions.

The traditional way to learn Forex trading is via textbook. Some people learn very well with this method and can translate the written word into something that works in the real world, though many find this very difficult to do.

The popular method to learn Forex trading is to buy an e-book, course or go to a seminar. All of these options will require you to learn to trade in a theoretical way. What I mean by this is, you will learn techniques, theories and tricks that do work but are still only theory until they are applied in the real market.

Many people simply cannot learn from a book and get confused with information overload. The problem is it's hard to know what technique to apply, in different circumstance. You can literally suffer a problem known as paralysis through analysis

After you have all the theory under your belt, there is no better option than learning from a live trader. A mentor will be able to show you how to read the market, what effect news will have, what times to avoid, and many other hidden factors that are almost impossible to list in one publication. This is a process of learning Forex through osmosis

Trading in a live market, gives you the advantage of real world situations. But trading a live market alone, will probably leave you pretty stressed out. By using the services of a live mentor, you can avoid much of that stress, and more importantly avoid making costly mistakes.

What better way to learn Forex than to have an experienced trader right there with you. This author would have paid thousands of dollars to get that experience at my fingertips.

Trading is a series of what I call "a-ha" experiences. It's not the knowledge that gets you to where you need to be, its only part of the journey. What gets you to where you need to be, is passing each trading milestone, as the lights of understanding go on, you'll be glad you took the trip with somebody who knows the way.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)